AMD Transforms into a Leading AI Chip Powerhouse, Following Nvidia's Path

Discover how AMD is transitioning into an AI chip powerhouse, positioning itself alongside Nvidia in the race for AI technology supremacy. Explore the future of AI-driven hardware and how AMD is reshaping the chip industry.

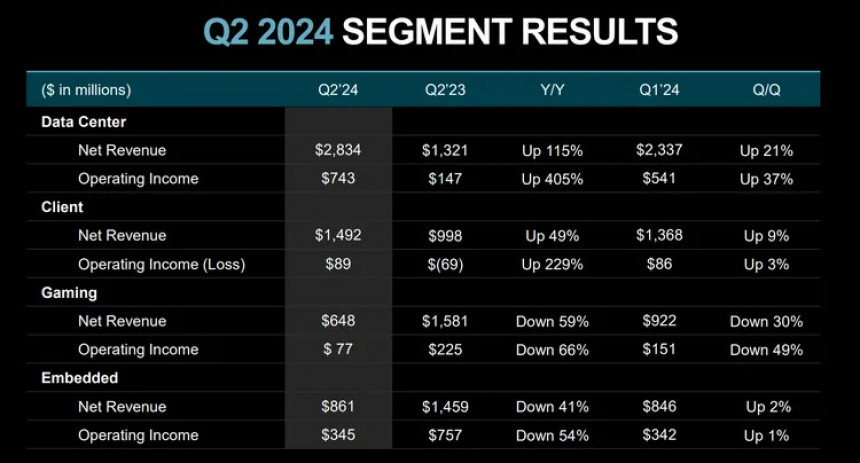

AMD Q2 2024 Earnings: Data Center Products Surge Amid AI Chip Success

AMD just released its second-quarter 2024 earnings, and the one number that jumps out of its results is this: nearly 50% of the company's revenue now comes from data center products-a large shift away from dependencies on PC chips, game consoles, and embedded.

AMD's data center business has more than doubled in size in the last year alone, largely fueled by the success of one key chip: the AMD Instinct MI300 accelerator. This powerhouse chip is positioned as a direct competitor to the Nvidia H100 AI chip and just sailed past $1 billion in sales within a single quarter. That is a huge leap considering it reached the figure of $1 billion cumulatively since its launch in December 2023, according to CEO Lisa Su. AMD's Epyc server CPUs also played in driving this growth.

Data center segments became an astonishing 115% thanks in great part to the MI300 chip. AMD appears to follow Nvidia's suit, whose chip on AI, the H100, was such a hit that Nvidia is already announcing new AI chips every year, thus pushing R&D efforts further forward if it wants to stay ahead of high competition in AI hardware.

AMD is on a similar track here, revealing new AI chips every year: first the MI325X in Q4 2024, then the MI350 in 2025, followed by the MI400 in 2026. Su said the MI350 will be "very competitive" with Nvidia's Blackwell, described as "the world's most powerful chip" for AI. While better supply chain logistics come into play, Su also conceded supply will remain constrained throughout 2025, with demand outstripping supply.

While AMD has been making impressive gains, Nvidia remains the leader by a large margin. Nvidia's data center business, driven by record revenues, reached $22.6 billion in the last quarter, whereas AMD's reached $2.8 billion. Yet AMD's rapid growth is a signal of its ambition to aggressively fight for share in this high-stakes market.

What does this mean to PC gamers-and anyone else-simply looking for new chips? All of this AI-driven R&D could trickle down to benefit other segments-meaning faster technological advancements in gaming GPUs and CPUs. But all of this attention to AI chips in 2024 might also equate to fewer new GPU releases aimed specifically at gaming.

Even so, AMD said its personal computing business was strong. Ryzen CPUs grew 49% year-over-year and up modestly quarter-over-quarter. Gaming revenue dropped 59%, as PlayStation and Xbox sales softened, but AMD's Radeon 6000 GPUs were up year over year.

Further ahead, AMD is expected to announce more than 100 different platforms powered by its Ryzen AI 300 "Strix Point" chips. While several have already begun to appear, including from Asus, HP, and MSI, Su confirmed that Acer and Lenovo are among other major players that are well-placed to announce Ryzen AI-powered laptops in the near future.